Alexandro's Case Study

Driver/ Store Associate settles $87,143.60 liability for $4,332

TaxRise reduces tax liability by 95%

| March 5, 2020

Saint Cloud, FL. – Alexandro of Florida receives needed assistance from TaxRise.

Alexandro Morgan* is a veteran working as a driver and a store associate. Since 2013, he had been steadily accruing bad credit as a result of a chronic illness for which he needed constant treatment.

Other factors contributed to his financial predicament as well. Alexandro was having to make habitual payments for his home’s mortgage, which he and his parents collectively paid for. However, the most troublesome of his financial worries was the wrath of the IRS.

Filing your taxes as someone who is self-employed can be extra complicated. Any mistake can result in a liability from the IRS.

Between 2013 and 2016, Alexandro had misfiled his taxes. For those that are self-employed, like Alexandro, unintentionally misfiling taxes is a common occurrence. Filing as self-employed is quite a complicated and tedious process when compared to many other forms of employment.

Unfortunately, Alexandro, as with most self-employed cases, was penalized with a serious liability for his filing mistakes. When Alexandro came to TaxRise, his vehicles and his property were in danger of being levied and seized.

TaxRise's Resolution Strategy

The TaxRise team conducted a thorough investigation of Alexandro’s tax history. Once we had compiled a strong case, we contacted the Revenue Officer in charge of Alexandro’s case.

During the negotiation process between the TaxRise team and the IRS, Alexandro’s AC broke and he had to spend $4k to fix it. Without wasting a moment, the experts at TaxRise were able to get Alexandro an extension with the IRS.

The IRS Case Examiner for Alexandro was a real stickler. They saw that our client’s 656 addendum had errors and needed to be revised. They also thought about giving him a tax lien after reviewing his case.

When Alexandro's AC broke, we got him an extension. When the IRS threatened with a tax lien, we negotiated a compromise.

TaxRise didn’t give up, and pressed on, fiercely negotiating with the IRS. We needed to convince them of Alexandro’s inability to pay what they were demanding of him.

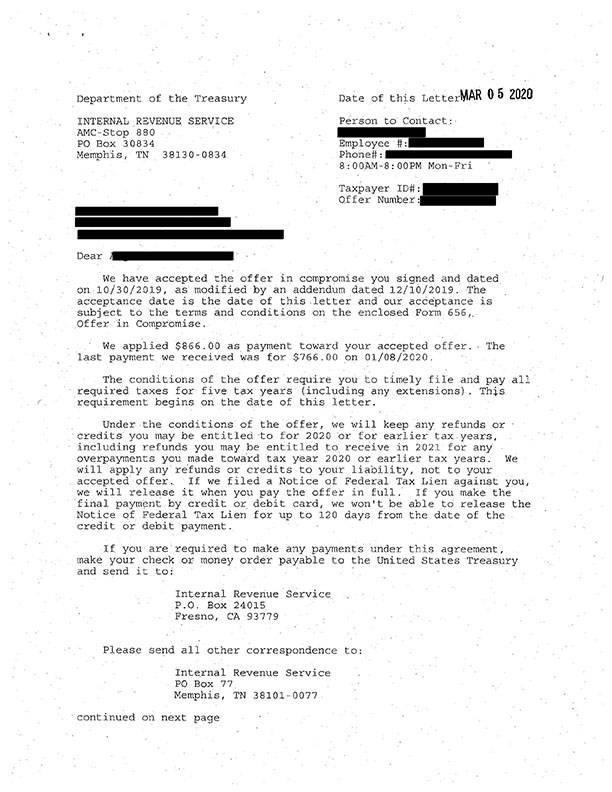

At last, the IRS agreed and signed the offer in compromise, which was likewise accepted by Alexandro. His total tax liability was reduced to $4,332 – a saving of over 95.1%.

The End Result:

Despite Alexandro misfiling his taxes from 2013-2016, TaxRise was able to help him avoid paying his tax liability in full, settling his $87,143.60 liability for $4,332.

See Alexandro’s accepted Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.