Beatrice's Case Study

Self-Employed Mother's Tax Debt Reduced by 90%

TaxRise reduces tax liability by 90%

February, 2020

Beatrice is a self-employed taxpayer that fell on hard times. She found herself getting behind on bills and before she knew it, she was behind on her taxes. Being self-employed makes paying taxes a little different, with quarterly payments for things like Social Security.

You can read more about filing while self-employed here.

After accruing a debt of $23,706, the IRS threats began. Beatrice became stressed and worried that the IRS had placed a levy on her account.

A mother, a self-made office manager, needed our help.

TaxRise's Resolution Strategy

In 2018, Beatrice came to TaxRise via an ad. A Resolution Officer listened to her story and knew instantly that she was a perfect candidate for the Fresh Start Initiative. This is a program that many taxpayers are unaware of, but is a great tool for tax relief.

The tax pro assigned to Beatrice’s case conducted a thorough investigation of her tax history. Upon the Discovery Investigation, the tax pro learned that there was not an active levy on Beatrice’s account. This is why it’s so important to seek the help of a professional that really takes the time to study your case.

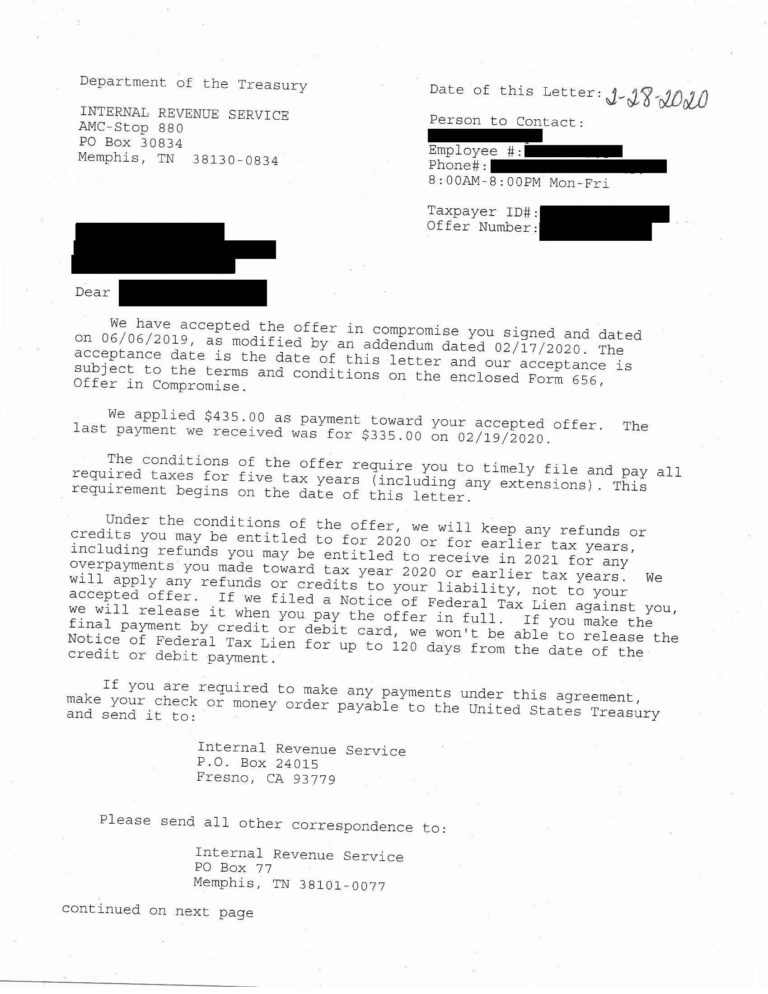

From there, an OIC (offer in compromise) was made that Beatrice approved of. The IRS saw her case, presented by a TaxRise attorney, and couldn’t deny that she was being charged significantly more than what is within her means.

The OIC was for only 10% of Beatrice's debt.

The End Result

The OIC for $2,174 was approved by all parties. This saved Beatrice 90% on her debt relief!

As of March 2020, Beatrice’s account is paid in full and closed. She has the financial freedom to focus on other things, like her business.

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.