Brett's Case Study

Hurricane Survivor's $15,904 Liability Reduced to $100

TaxRise reduces tax liability by 99.4%

| June 2, 2020

WINNABOW, NC. – With the assistance of TaxRise, Brett of North Carolina settled his tax liability.

Brett King* had been in and out of work for some time, until he landed a position in the construction industry. Brett owed back taxes as far back as 2007. So, he began taking steps to get his financial situation under control.

However, his life and finances would be flipped completely upside-down when Hurricane Florence hit in 2018.

Hurricane Florence would put Brett in significant financial hardship.

In the wake of the hurricane, almost all of his possessions were either destroyed or ruined. His home, his clothes, his tracker, his important files…everything. To make matters worse, in his struggle to salvage the wreckage, he injured his back.

Having a career in construction and having an injured back, he would effectively be unable to return to his field of expertise.

Then, at the height of Brett’s hardships, the IRS sent him a letter for $15,904 worth of unpaid penalties and interest.

TaxRise's Resolution Strategy

TaxRise’s tax experts immediately instructed Brett to write up a hardship letter, proving to the IRS his inability to pay back what was being demanded of him.

Multiple times during the battle for Brett’s financial future, the IRS denied our offer in compromise and the Power of Attorney. Despite these constant setbacks, TaxRise did not give up on Brett.

Using a letter proving hardship, TaxRise hoped to strike a deal with the IRS and release Brett from his tax liability.

Using the hardship letter, the assigned TaxRise attorney was able to negotiate with the IRS to create an offer in compromise for Brett, arguing for a payment that he could reasonably afford.

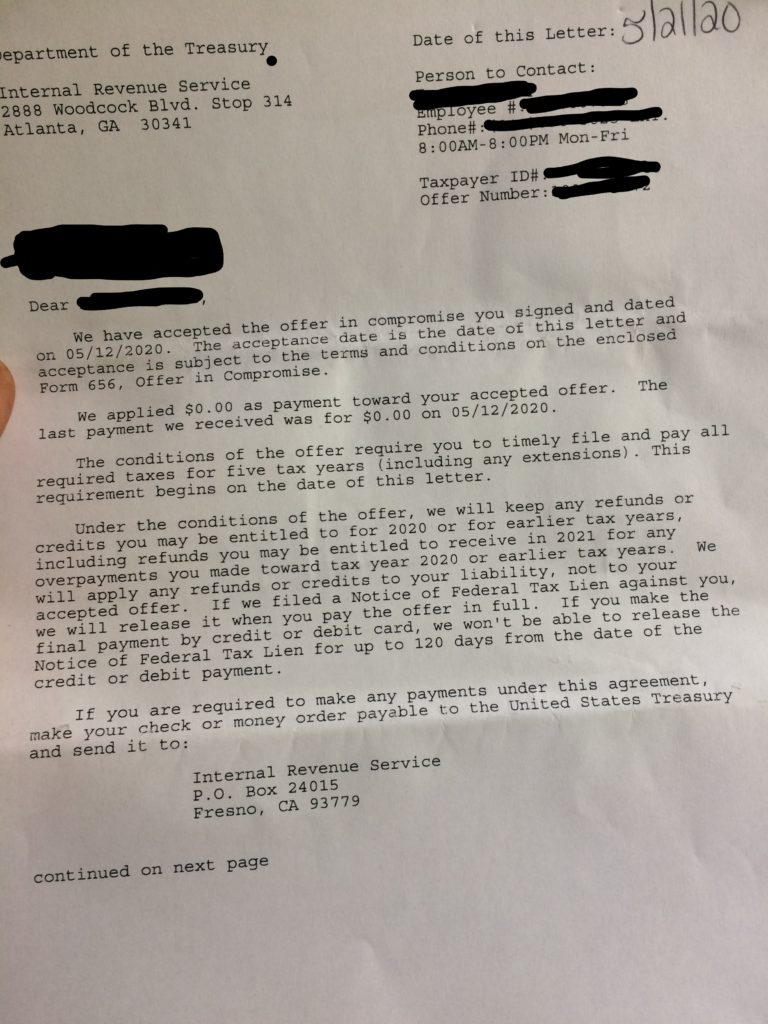

Brett accepted the letter in compromise, and his liabilities of $15,904 were cut down to $100.

The End Result

The TaxRise Team guided Brett through the processes of drafting a hardship letter, which convinced the IRS to lower the $15,904 liability to $100. This was an amount Brett could reasonably afford – saving over 99.4%.

See Brett’s accepted Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.