Caesar's Case Study

$202,881 Reduced to $500- Avoiding Prison

TaxRise reduces tax liability by 99.8%

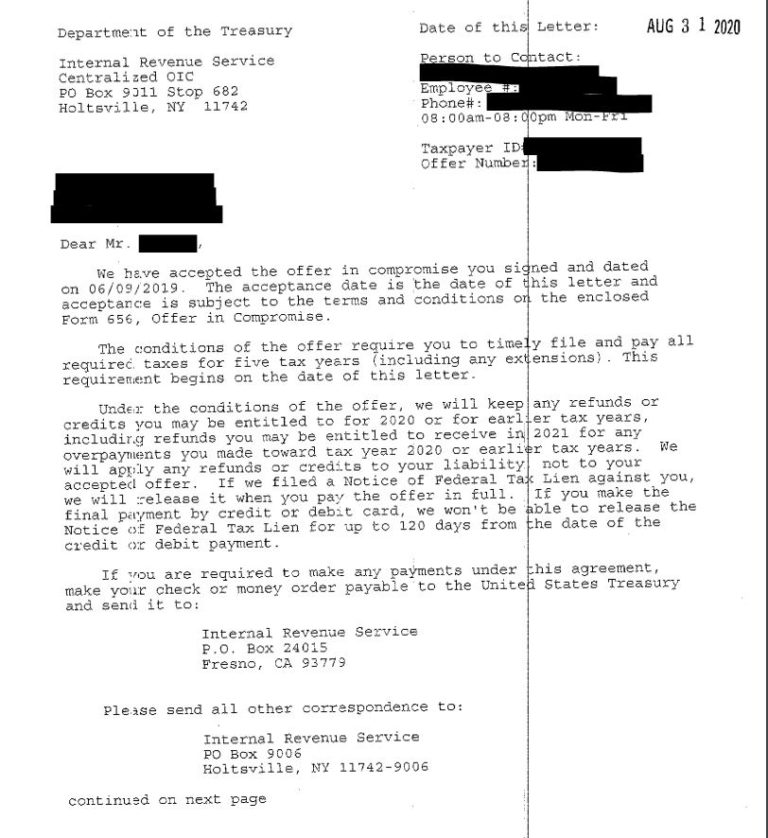

August 31, 2020

Caesar* fell on hard times during his retirement. He hadn’t paid his federal taxes in a long while, so interest and penalties were stacked against him. Being retired, Caesar doesn’t have the income that he once did. There was no way for him to pay the egregious amount he owed in back taxes.

His liability had risen to over $200,000.

A lien was placed on Caesar’s bank account. He told us that it was then he began to fear that he, or even his son could go to prison due to unpaid taxes. His liability had risen to over $200,000. This was one of the largest cases we handled, but we saw it as an opportunity to change someone’s life.

TaxRise's Resolution Strategy

The first step was to figure out exactly how much Caesar owed in federal taxes. We refer to this step as the Tax Discovery. This is a 10-year investigation of your tax history, allowing us to find out if you owe more or less than the IRS claims.

The Tax Discovery proved that Caesar owed $202,881. Having the correct number, the TaxRise team could now start negotiating resolutions based on Caesar’s income. Because he’s retired and struggling to get by financially, we knew he could afford very little.

An offer was submitted to the IRS on Caesar’s behalf for only 0.2% of his liability.

Caesar owed $202,881.

The End Result

The IRS accepted our offer to reduce Caesar’s tax debt to $500, for a total savings of 99.8%!

Rightfully, Caesar’s case is one for our Hall of Fame. No debt is too large for TaxRise!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.