Cate's Case Study

Breast Cancer Fighter Takes on IRS and Wins

TaxRise reduces tax liability by 99%

May, 2020

Cate is a retired mother from Alabama with several medical conditions, including breast cancer. Medical bills and medicine are all necessary expenses and, for a senior relying on Social Security, are hardly affordable.

The IRS can be aggressive with their collection tactics. This proved to be a scary time for someone that was already battling so much.

Unfortunately, that doesn’t stop the calls and threatening letters.

TaxRise's Resolution Strategy

At TaxRise, once we take control of a case, the IRS must cease directly contacting our clients regarding their tax debt. So long as you’re complying, they cannot legally pursue payments from you.

In 2018, Cate found TaxRise. With the hands-on assistance of her daughter Crystal, she quickly completed all of the required documents to enter our tax relief program.

At the time of starting her case, the Alabama retiree owed the IRS $42,242.

Being in that much debt, her daughter Crystal grew increasingly worried about the toll that could take on her mother’s health. That much stress in already trying times is enough to make anyone crack.

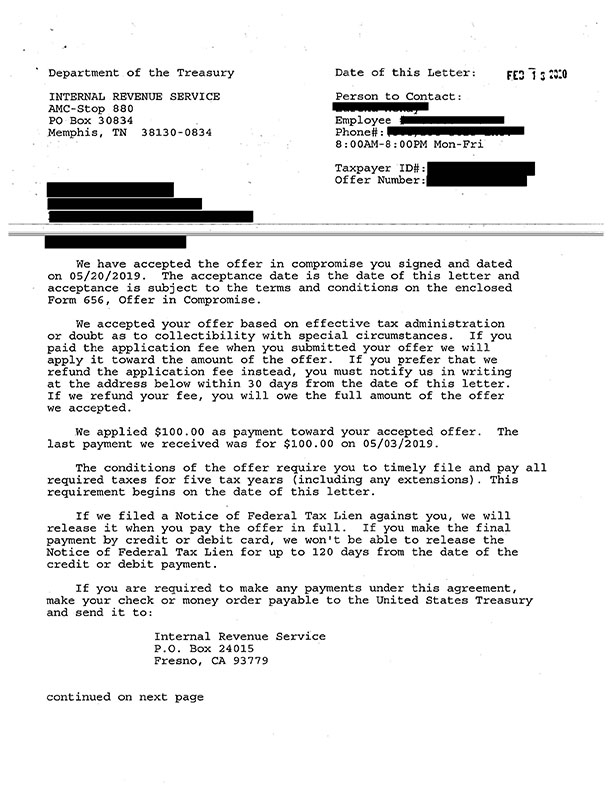

Cate’s TaxRise team made an offer in compromise (OIC) that wasn’t accepted by the IRS at first. We persisted and pushed for the offer, wanting to do right by Cate. Our clients matter and we want them to know that we’re willing to fight for as long as it takes.

Luckily for Cate, it didn’t take too long.

The End Result

Early 2020, the OIC was accepted by the IRS and Cate. The offer was for 1% of her total debt.

That’s right, Cate saved 99% on her tax debt! The balance owed dropped from over $42,000 to just $500.

Crystal wrote to Cate’s Case Manager expressing how appreciative they both are. Now, Cate can just focus on getting healthy without the added stress of tax debt.

Be the next success story! Take our survey now and we will put you in touch with a resolution officer today!

* Client’s name changed for privacy.