Emmanuel's Case Study

Retiree Has One of the Largest Savings in TaxRise History

TaxRise settles liability by over 99.8%!

| July 12, 2019

Yonkers, New York – With the expertise of TaxRise, retiree Emmanuel Garcia was freed from the lien on his accounts and his $46,537.72 debt.

In the case of many taxpayers, if they cannot afford to pay their taxes for one year, they avoid paying their taxes and wait to pay it back the next year. However, the IRS adds interest and penalties to unpaid taxes – compounding an already bad situation.

Debt has the potential to haunt you for your entire life. Debt can also grow perpetually worse and worse until there is no feasible way you can pay it back. For our client Emmanuel, his situation was no different

Emmanuel had a very large debt; there was no realistic way for him to pay it back.

Back in 2005, Emmanuel owed some money to the State and Federal government. He was unable to pay the required amount, and year after year, he still could not pay anything towards the ever-increasing total.

At last, in 2018, Emmanuel found himself staring at an enormous debt of $46,537.72. To make matters worse, he received a letter in the mail from the IRS announcing their intention to place a lien on his accounts.

TaxRise's Resolution Strategy

Quickly reviewing Emmanuel’s case, the TaxRise team realized that Emmanuel would be a strong candidate for an OIC – he just needed the right people to negotiate with the IRS on his behalf.

An OIC stands for offer in compromise, the most ideal debt resolution available to taxpayers.

The reason why Emmanuel was such a strong candidate was because he was retired and only earning minimum SSI and a very small monthly pension. There was no reasonable way he could pay back what the IRS was requiring of him.

TaxRise used Emmanuel's economic situation to negotiate with the IRS for an OIC.

As the experts at TaxRise quickly got to securing both the power of attorney and the OIC for Emmanuel, we made a slight adjustment with our client. Emmanuel’s first language was Spanish; to make communicating as convenient as possible for Emmanuel, we assigned our bilingual staff to his case.

The case was not without its difficulties and hardships, but TaxRise persevered for our client. We made every effort to ensure that Emmanuel was informed and involved with our tax relief process.

In the end – after much negotiation – TaxRise was able to free Emmanuel from the lien on his accounts, and we were about to settle his debt for one of the greatest margins in TaxRise history.

The End Result

Emmanuel’s offer in compromise was accepted for $100 and the lien was removed! With his initial debt starting at $46,537.72, we were able to settle his debt for 0.2% – a savings of over 99.8%!

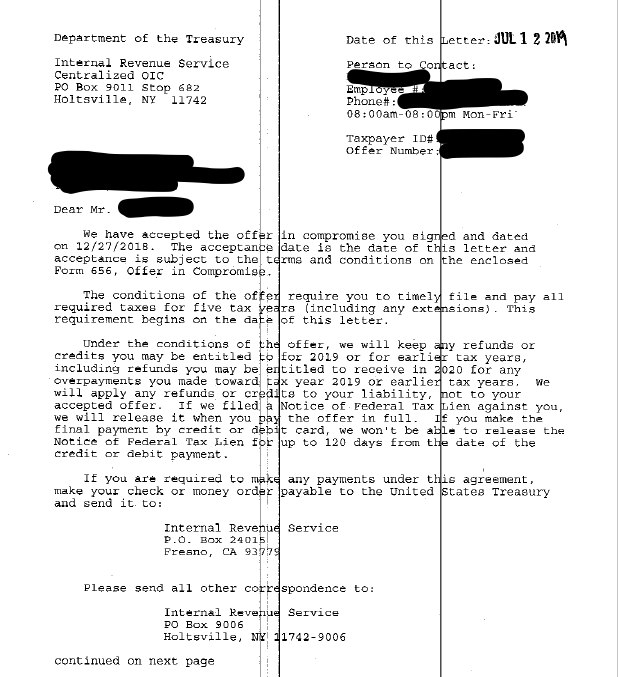

See Emmanuel’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.