Gina's Case Study

$21,115 Reduced to $500 in Victory for 2 Survivors

TaxRise reduces tax liability by 97.7%

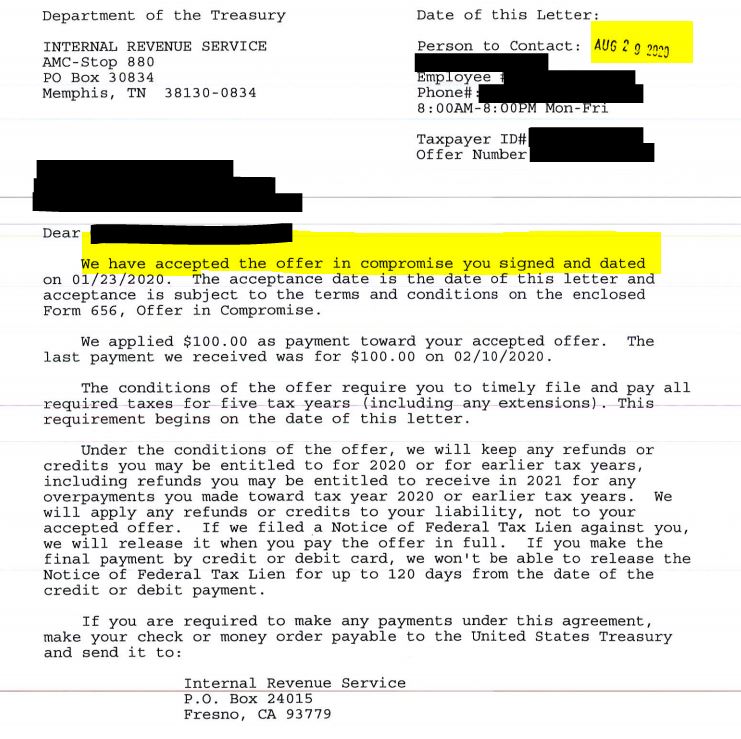

August 29, 2020

Retirement should be a relaxing time without the stress of affording survival. Unfortunately, this was not the painted picture for Gina Terry*. Surviving on Social Security Income (SSI) and her husbands’ National Guard checks ($200), she was being harassed by the IRS for owing back taxes.

The couple was barely getting by...

Gina was diagnosed with ovarian cancer. She and her husband are without a vehicle and 401(k). The couple was just barely getting by, not able to afford much other than rent. Gina’s health insurance assists with medical bills, but a large bill from the IRS simply wouldn’t be feasible.

In 2018, Gina was unable to work and neglected to file. If you do not file taxes, whether or not you were employed, there could be consequences. The IRS can take it upon themselves to file for you, in which they will assume that you had the same income as you did the year prior; or you will be hit with late penalties and interest for the following year.

TaxRise's Resolution Strategy

Her TaxRise team investigated her tax history and came to the conclusion that she owed $21,115. With Gina’s income, it would be impossible for her to pay that amount.

We put together her OIC (offer in compromise) packet, which detailed her and her husband’s income and expenses. OIC packets also tend to include a letter of hardship, outlining the trials and distress of our clients.

2.3% of $21,115

An offer was submitted for Gina’s tax debt to be reduced to only 2.3%.

The End Result

The offer was successful and the IRS accepted. Gina only owed $500 of her original liability of $21,115! TaxRise was able to save her 98% with this offer! Today Gina’s tax debt is paid in full and she’s compliant with the IRS.

You can view Gina’s accepted OIC below.

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.