Karl's Case Study

Injured Worker Reduces Tax Debt by $21,000

TaxRise reduces tax liability by 86.7%

March 3, 2020

Karl* was injured and out of work. Something that shouldn’t crush the lives of taxpaying Americans, but did. He and his wife, Sherry, were just barely hanging on and in need of help.

The IRS is not an empathetic agency that will work with your hardships. Instead of providing affordable solutions, the IRS placed a total of 4 liens on the couple’s tax reports.

The IRS essentially seized ownership of their assets.

Karl and Sherry found a company in Michigan that attempted to convert their status to No Pay. The couple paid $7,000. That company failed.

Another tax company in California achieved the No Pay status, but failed to inform the couple of the activities on their case. A lack of communication is a lack of trust.

TaxRise's Resolution Strategy

So, with 4 liens and $24,817 of tax debt, without employment, Karl and Sherry finally found TaxRise.

In 2018, the team here at TaxRise took the time to hear their story and understand their case. Once it was passed on to one of our expert attorneys, the battle with the IRS began.

The first offer in compromise (OIC) was rejected. TaxRise fought harder!

The End Result

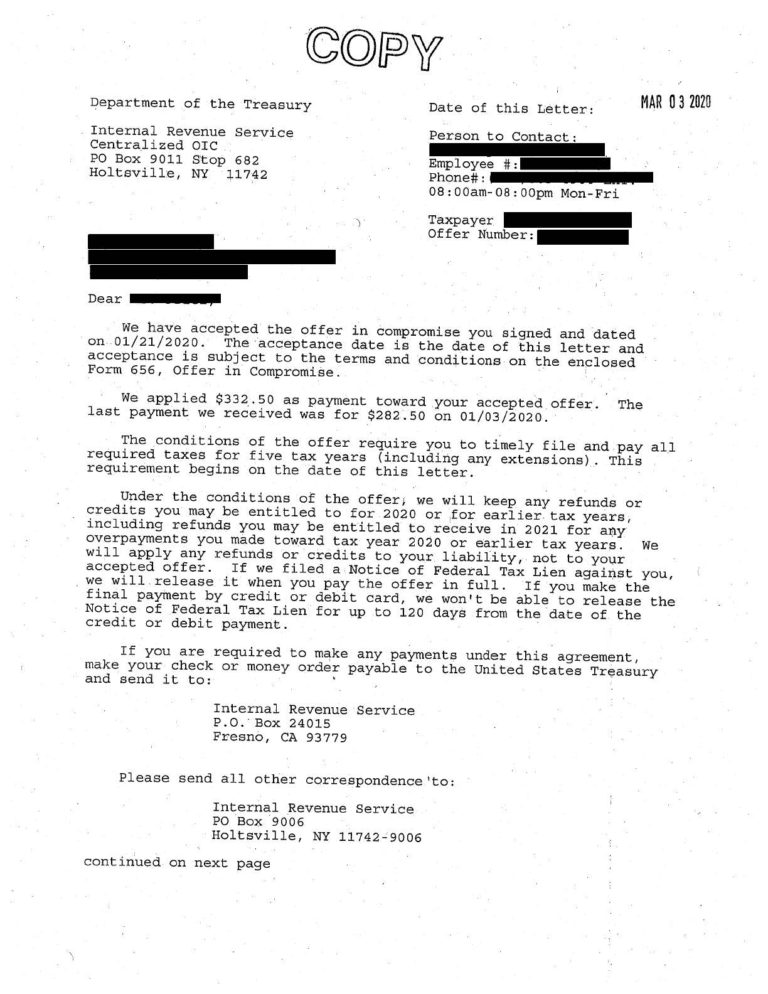

In 2020, Karl and Sherry’s tax debt is resolved!

With an expert attorney, their debt was lowered to $3,320. That’s 86.7% of savings! That’s the magic of what we do at TaxRise.

We hold our whole team to the highest standards. Where those other companies failed, we succeeded and surpassed.

Are you next? Take our pre-qualifying survey here!

* Client’s name changed for privacy.