Mitchell's Case Study

$23,329 Reduced to $500 for SS Recipient

TaxRise reduces tax liability by 97.9%

September 9, 2020

In September of 2019, Mitchell* was forced to stop working. From there he relied on Social Security for income and had to change his health insurance. After purchasing a vehicle, expenses were piling up as he was challenged with various health issues.

Diabetes, chronic neck and back pain, and sleep apnea all plagued his day-to-day. Mitchell was unable to make consistent payments on his back taxes, resulting in him being hit with penalties and high interest rates. Naturally, the stress began to way on him and he has been fighting depression.

The added tax debt was impossible for him to pay.

$23,329 in debt, Mitchell found the help he needed with TaxRise. He informed us that he lives frugally, but his income just barely covers his expenses. The added tax debt was impossible for him to pay.

TaxRise's Resolution Strategy

Mitchell’s TaxRise team asked him to draft a letter of hardship. This is a personal letter that is sent to the IRS with the offer packet to help a case. We tend to ask our clients for these letters so that the IRS rep can get a glimpse into the life of our client.

The IRS paints the picture that delinquent taxpayers are bad, but the reality is that our clients are just subjected to hard times. Showing humility and vulnerability can sway a case significantly.

...we didn’t give up on our client.

The End Result

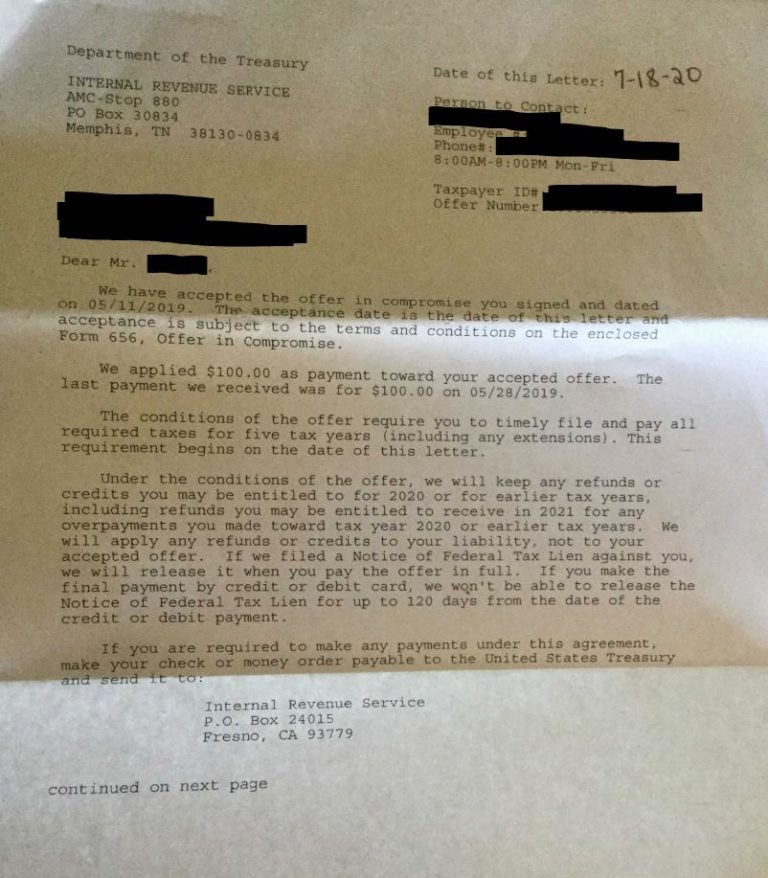

The IRS did not accept the first offer that was shown to them, but we didn’t give up on our client. We reconvened and drafted a new offer. In the end, Mitchell’s debt was reduced to $500, saving him 97.9%! He only paid 2.1% of his original liability, $23,329.

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.