Sharon's Case Study

83% of Social Security Tax Debt Forgiven

TaxRise reduces tax liability by 83%

September 2, 2020

Sharon’s* troubles began with a common mistake. As a recipient of Social Security benefits, she wasn’t aware that she had to pay taxes. Social Security is not tax free, but a lot of people think that it is. While there are exemptions that some taxpayers qualify for, it is crucial to file your income while receiving any kind of benefits. You can read more about paying SS taxes here.

Tax Myth: SS is Tax Free.

A year passed and Sharon was not in-the-know about her accumulating liability. It wasn’t until she received her pension that the IRS told her she owed $10,000.

TaxRise's Resolution Strategy

Her liabilities were from her 2014-2017 taxes. The first step for TaxRise was to get Sheree current on her returns. An offer in compromise (OIC) was submitted after her 2018 taxes were filed. This was a way to ensure the balance was as updated as possible, and Sharon’s OIC application would be sent with it to be viewed right away.

Once Sharon’s balance was updated, she owed $6,108. Her monthly expenses and budget could not handle another large bill. The TaxRise team made sure that every expense was accounted for, notating her income and bills, even medicine and groceries. All of these things proved her financial hardship.

From $10,000 to $6,108 before the OIC was submitted.

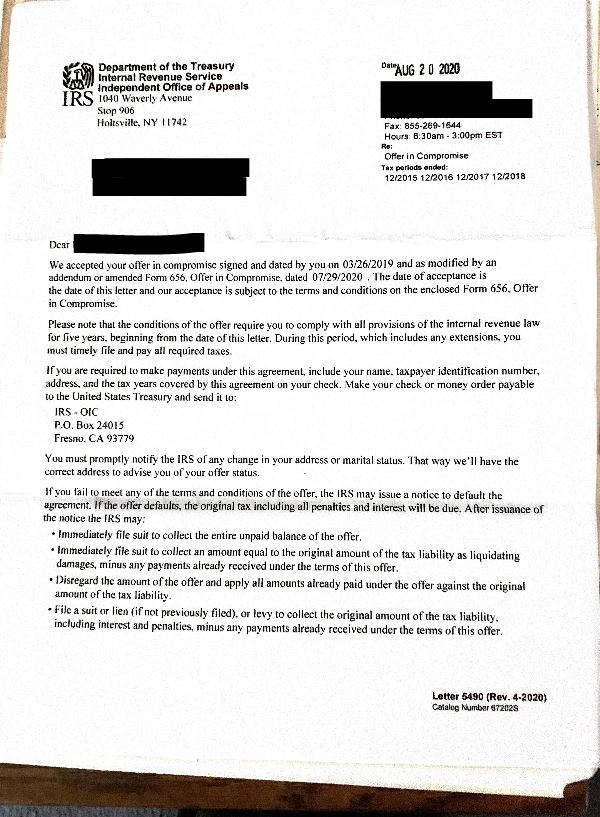

The End Result

An offer was submitted, and negotiations began. Because Sharon is married and filed jointly, her spouse’s income was also accounted for. Still, we were able to achieve the best possible outcome for her case.

Sharon’s liability of $6,108 was reduced to $1,040, saving her over 83%! The offer was for Sharon to pay 17% of what she owed, and that was the best resolution for her case.

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.