Von's Case Study

Disabled and Divorced Veteran Resolves $41,843.23 Tax Debt

TaxRise settles the debt for 1.19%

| April 26, 2019

Laton, California – With the aid of TaxRise, a disabled and newly divorced veteran’s debt was reduced tremendously.

Von Borne* is a veteran who became disabled in 2017 and divorced in 2018. Research has shown that one of the primary causes of divorce is a financial strain, and as such, both Von and his ex-wife left their marriage with significant monetary troubles.

Von had financial problems dating back long before his disability and divorce. These issues would continue to follow him (the IRS is not likely to forget about those who owe them money), and unfortunately for Von, he could not work.

Von's divorce was the result of financial strain.

When Von incurred the injury that rendered him disabled, he would be hospitalized for quite some time.

Although his disability enabled him to collect benefits in the form of both disability and Social Security, he was still low on funds. As is the case with many of our clients, economic benefits are never enough when one is unable to work.

Von did not receive a letter from the IRS. Still, in due time he would get a taste of their harassment if he didn’t take action. So, he reached out to TaxRise.

TaxRise's Resolution Strategy

Von’s case turned out to be one of the most complicated, back-and-forth, and intensive cases that our tax experts had ever dealt with.

To make things more difficult, the IRS examiners were adamant. It took all the negotiation skills TaxRise could muster to get the IRS to budge on various positions. For example, our propositions for the power of attorney and our offer in compromise were rejected multiple times.

The IRS put up significant opposition to TaxRise's efforts.

Power of attorney (POA) is a status that protects our clients from IRS collections. An offer in compromise (OIC) is an agreement to settle a debt for an amount that the client could realistically pay. Both are vital to the success of a case; they were both rejected many times.

Eventually, the appeals examiner attempted to close out Von’s case with a Rejection Sustained, which would block an offer in compromise and force Von to go on a monthly payment plan.

TaxRise didn’t quit on our client, despite the complexity of the case and the staunchness of the IRS. After almost two years, we succeeded in placing Von in a resolution.

The End Result

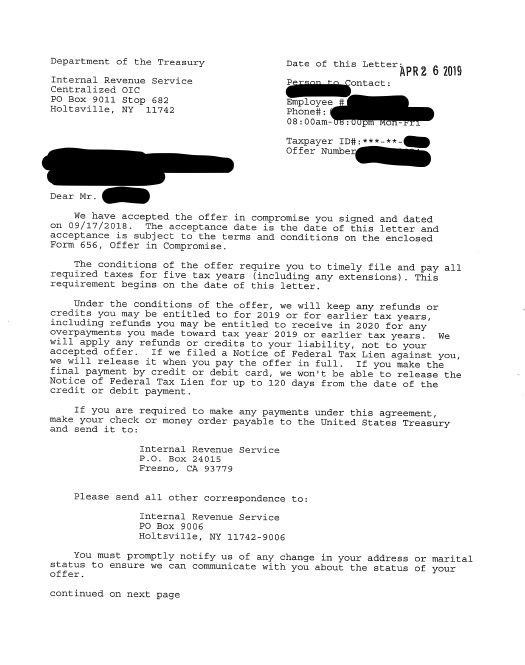

The tax professionals at TaxRise negotiated with the IRS to settle Von’s $41,843.23 debt for $500!

See Von’s signed Offer in Compromise Below!

Be the next success story. Take our survey to see if you qualify for the Fresh Start program.

* Client’s name changed for privacy.